With credit score becoming the latest buzzword when applying for a credit card or a loan it is absolutely essential to understand the concept. Simply put, credit score is a number given to you based on your financial performance with respect to debts and bills. If you have been regular with your EMI and credit card payments, used credit cards only up to a certain limit, and haven’t applied for cards or loans very frequently, you are likely to get a good score which will aid you in your future credit loan applications. However, a low score won’t be music to your ears!

In India, one of the front runners in credit score is CIBIL. Let’s find out more about this institution and their scoring system – CIBIL score.

Importance of CIBIL Score

Credit Information Bureau India Limited or CIBIL is one of as India’s first credit information company. They obtain payment records of individuals or commercial entities that have bank loans or own a credit card from the issuing lending institution. These details are then synthesized to form the Credit Information Report (CIR), which eventually gives way to the CIBIL Credit Score. CIBIL Score helps banks and NBFCs (non-banking financial corporations) to evaluate fresh loan applications from these individuals and decide whether to approve or reject their applications.

How do banks use the CIBIL score?

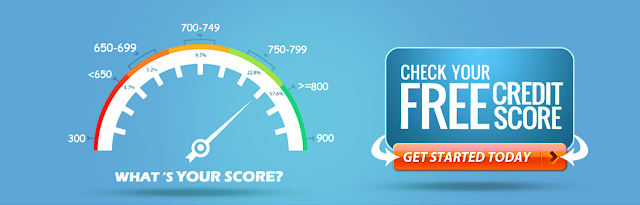

CIBIL score ranges from 300 to 900. So, individuals scoring closer to 900 are highly likely to get approved for loans and cards on favorable terms, whereas for individuals scoring close to 300, getting approval on new credit applications will be difficult.

Depending on how high or low an individual scores, banks and NBFCs get a glimpse of the applicant’s financial behavior and credit-hungry attitude. If they see that you have been applying for loan and credit cards very regularly, they feel that you are in constant need of money and are unable to manage your budget in the finances already available to you. Second, if you are always behind on your EMIs and credit card bill payments, it means that you are lazy and lack financial discipline. These factors make banks wary of lending you more money.

Top five factors that affect CIBIL Score

Among the various factors that can affect your CIBIL score, the following five deserve special mention.

- Repayment History – For an individual sharing a history of repayments in due time brings an positive impression on his/her CIBIL Score. This includes clearance of all the previous bills and loan repayments within the stipulated time period. Any amount of due or missed payments or payment that is overdue, brings a negative impression on your score indicating trouble in clearance of your repayments.

- Debt Servicing Time Duration – The entire period of time for which you have been using the credit is one of the major factor that aids in the process of calculation of the cibil score. For an individual servicing the debt for a much elongated period of time and also ensuring absolute timely repayment also helps to improve the score.

- Optimum Utilization of Credit Limits – In the present days, credit cards make availability of high credit limits. For any person who makes the optimum use of these limits brings a poor impact in his/her cibil score.

- Higher Percentage of Credit Cards or Personal Loans – For an individual whose is sharing a more secured loan (a home loan or an auto loan), that person share the chance of sharing a more positive score as compared to other individuals who are sharing a more unsecured loans. The most expensive form of credit is unsecured loans as the more higher the number of unsecured loans , higher are the payments as they counts very high interest rates. Thus when a person has more number of unsecured loans, he/she is more liable to share a lower credit score.

- Credit Applications – Nowadays application for multiple loans and credits is a common practice, but this particular practice mostly brings a negative impression on the CIBIL Score. For individuals who are in constant application for more credit or have just sanctioned a new loan, strict caution is exercised. Innumerable credit application refers to the low capability of the individual for any further additional dept and also indicates the person’s debt burden.

Other Factors

Some other factors that affect the CIBIL Score are mentioned below:

- Loan Settlement - When people are unable to settle their loans, it affects highly on their cibil score. In such cases, the banks sometime also reject loan requests.

- Reducing number of Credit Cards - Reduction or cancellation of credit cards brings down the credit limit bringing a negative impact on your score.

- Suspension of Credit Card Use - Suspension or lack of money transactions using the credit card makes your credit file an inactive one.

- Not Checking the Credit Report – If banks misreport facts on the credit report, delay or not rectifying the errors makes bearing on the cibil score.

EmoticonEmoticon